Here is the ultimate truth about life insurance: the only policy that matters is the one that is in force on the day you die. – Tom Hegna, economist, author, retirement expertTom Hegna’s quote is powerful. If you have loved ones who would suffer financially should you pass away, you need a life insurance policy that is in force.

Seniors generally have five options for life insurance. We’ll review each type to help you make an informed decision.

When you’re ready to apply, you can be confident that you’re purchasing the best policy you qualify for at the most competitive price.

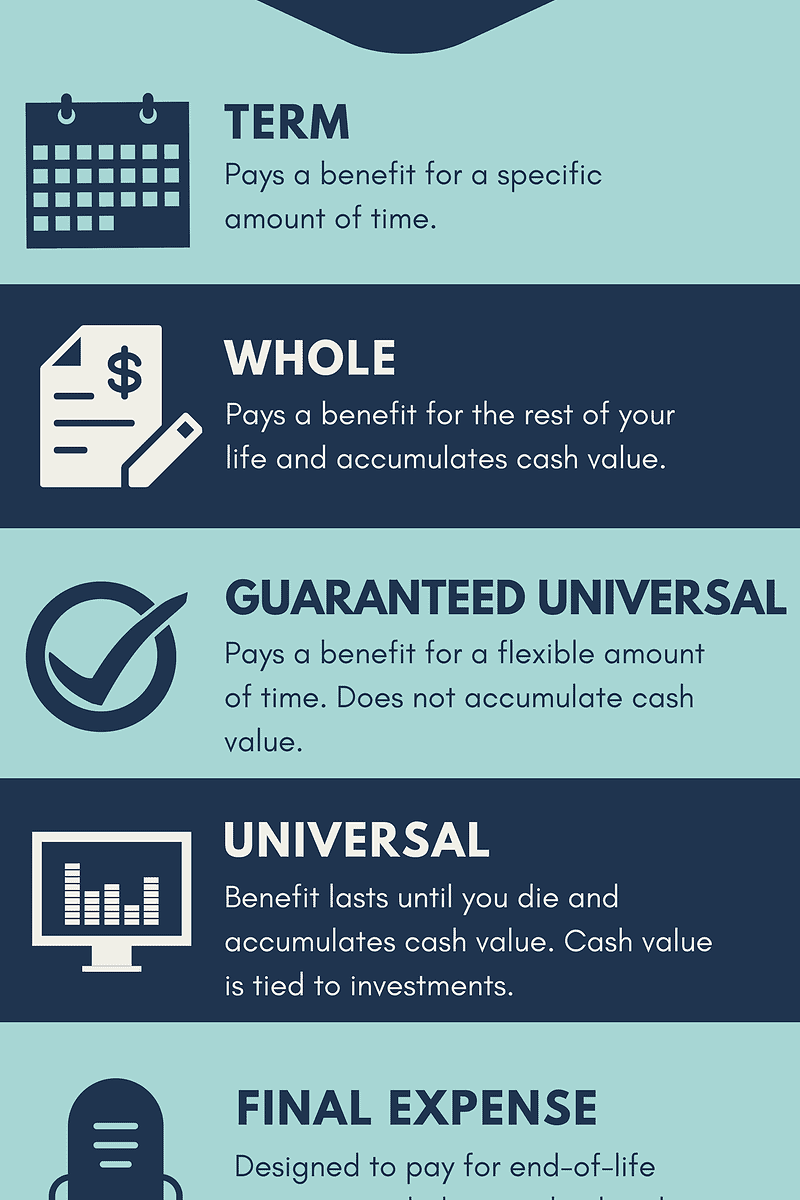

Five Types Of Life Insurance For Seniors:

1. Term

2. Whole

3. Guaranteed Universal

4. Universal

5. Final Expense

Next Steps:

How To Apply

1. Term

As the name implies, term life insurance provides a benefit for a specific amount of time. Contrary to popular belief, term life insurance is purchased by seniors regularly.Primary components to understand about term when deciding if it’s a good fit for you:

- How old are you? At some point, your age can disqualify you from

purchasing term. Each life insurance carrier is different, but generally

age limits look like this:

- 80 years old – 10 year term

- 75 years old – 15 year term

- 70 years old – 20 year term

- 65 years old – 25 year term

- 58 years old – 30 year term

- Unsurprisingly, term life insurance premiums increase with age.

- How is your health? Less than perfect health means higher premiums or a possible decline. As we age, its common to develop chronic health conditions including:

One more thing – there are no exam (simplified issue) term life insurance options for seniors, too. At up to age 65, healthy seniors may be able to purchase a moderate amount of term life insurance (up to $500,000). From ages 66 – 75, healthy seniors may have the options to purchase a modest policy of up to $99,000.

2. Whole

Whole (permanent) life insurance provides a death benefit for the rest of your life and also accumulates a cash value. Unlike term life insurance, whole life insurance remains in force as long as you pay your premiums. Additionally, your premiums remain the same amount for the life of the policy.What is a cash value?

Cash values, which accumulate on a tax-deferred basis just like assets in most retirement and tuition savings plans, can be used in the future for any purpose you wish. If you like, you can borrow cash value for a down payment on a home, to help pay for your children’s education or to provide income for your retirement. When you borrow money from a permanent insurance policy, you’re using the policy’s cash value as collateral and the borrowing rates tend to be relatively low. And unlike loans from most financial institutions, the loan is not dependent on credit checks or other restrictions. You ultimately must repay any loan with interest or your beneficiaries will receive a reduced death benefit and cash-surrender value. – Permanent Insurance, Life Happens, a nonprofit life insurance awareness organizationWhole life insurance has some main characteristics:

- Not common for seniors to purchase, however can make sense in some instances:

- Desire to leave a specific amount to a beneficiary (i.e. family member, university or charity).

- Utilize the policy loan option.

- As a strategy to minimize estate taxes.

- Policy lasts a lifetime.

- Premiums are more expensive than term life insurance.

- Accumulates cash value.

- Ability to take policy loans from the cash value.

- Underwriting guidelines are similar to term life insurance for seniors.

- Usually the cutoff age for purchasing whole life is 75-80 years old.

- Your age and health factor into whether or not you qualify for whole life insurance.

3. Guaranteed Universal

Think of Guaranteed Universal life insurance (GUL) as a branch between term and whole life insurance. GUL is regularly recommended to seniors because it has some of the appealing aspects found in both term and whole life insurance.Key features of Guaranteed Universal life insurance:

- More affordable than whole life insurance.

- Tends to be more expensive than traditional term life insurance.

- GUL is technically not considered permanent life insurance because you select the length of the policy.

- However, the policy length is routinely expected to outlast your life.

- Does not accumulate a cash value.

- Premiums can be level for a lifetime.

- Premiums are not tied to investment volatility or interest rates.

- GUL is often often used for:

- Minimizing estate taxes.

- Providing a legacy to a beneficiary.

- Financing end of life expenses.

- The underwriting process is often the same as a term life insurance application.

4. Universal

Universal life insurance (UL) lasts a lifetime. The name implies that it’s similar to a GUL. However, there are some key differences and Universal life insurance is usually not purchased by seniors.Let’s examine the specifics:

- Universal life insurance is considered a form of permanent life insurance as it lasts a lifetime.

- UL does have a cash value component.

- Cash value is directly linked to policy’s investment performance.

- Ability to take policy loans against the cash value of the policy.

- Designed to provide flexibility in your policy:

- Premium payments must be made to cover the cost of the policy.

- Additional premium payments can be made to the savings component of the policy.

- Policy is directly affected by the volatility of its investments.

- In other words, the investment earnings are not guaranteed.

- Depending on the policy’s performance, premium payments may need to be increased to maintain the policy.

- Death benefit is adjustable.

- Underwriting guidelines for UL are usually the same as a term life insurance application.

5. Final Expense

Final Expense (FE) life insurance makes all the sense in the world for seniors under certain circumstances. Aptly named, Final Expense works well for those seeking funds to cover end-of-life financial needs.What you need to know:

- Final expense is permanent life insurance and lasts a lifetime.

- FE secures funds for end of life costs:

- Funeral and burial expenses.

- Medical bills.

- Policies amounts typically range between $50,000 – $100,000.

- Often FE policies can grow a cash value, meaning that you can access funds during the life of the policy (policy loans).

- Underwriting for Final Expense is different than standard term life insurance:

- Approval can be instant, after you pass the health questionnaire.

How To Apply

Your life insurance needs determine which policy is the best fit for you. Seniors have specific life insurance considerations and as an independent life insurance agency, we’ll collaborate with you to find the best policy at the most competitive price. Independent agents are not held captive to a particular life insurance carrier and you will receive multiple quotes from multiple carriers.This is important – Some life insurance is better than none. And, the best time to become insured is today.

To get started, contact us.

Or, simply fill out our instant quote.

Leave a Reply